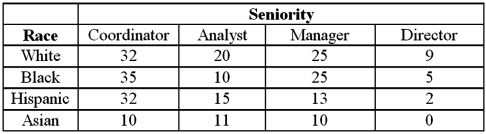

Exhibit 12.6 The following table shows the distribution of employees in an Organization.Martha Foreman,an analyst wants to see if race has a bearing on the position a person holds with this company.  Refer to Exhibit 12.6.For the chi-square test of independence,the value of the test statistic is:

Refer to Exhibit 12.6.For the chi-square test of independence,the value of the test statistic is:

Definitions:

Social Security Taxes

Taxes collected to fund the Social Security program, which provides retirement, disability, and survivorship benefits to qualifying individuals.

Tax Rate

The percentage at which an individual or corporation is taxed, which can vary based on income level, type of good, or transaction being taxed.

Marginal Tax Rate

The rate of tax applied to the last dollar of income, reflecting the tax bracket into which the incremental income falls.

Average Tax Rate

The Average Tax Rate is the proportion of the total taxable income paid as taxes, calculated by dividing the total amount of taxes paid by the total income.

Q12: The equation y = β<sub>0</sub> + β<sub>1</sub>x

Q34: For the goodness-of-fit test,the chi-square test statistic

Q35: What type of test for population means

Q38: Exhibit 10.5.A producer of fine chocolates believes

Q40: The accompanying table shows the regression results

Q55: The correlation coefficient could be considered as

Q66: The standard error of the estimate measures<br>A)the

Q72: Compute a 98% confidence interval for the

Q78: Consider the following regression results based on

Q85: A portfolio manager is interested in reducing