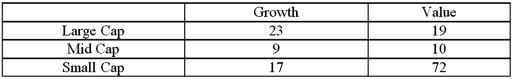

The following table shows the cross-classification of hedge funds by market capitalization (either small,mid,or large cap)and objective (either growth or value).

A)Set up the competing hypotheses to determine if market capitalization and objective are dependent.

B)Calculate the value of the test statistic and determine the degrees of freedom.

C)Compute the p-value.Does the evidence suggest market capitalization and objective are dependent at the 5% significance level?

Definitions:

Cross-cultural

Describes interactions or comparisons between different cultures, emphasizing diversity and the exchange of ideas, values, and practices.

Global Perspective

An approach to understanding issues, cultures, and events across the world that considers the interconnectedness and interdependence of countries and peoples.

Serial Monogamy

A pattern of engaging in successive monogamous romantic relationships, one after the other, without overlapping them.

Norms

Collective norms and guidelines that influence the actions of individuals within a group.

Q21: Exhibit 16.6.Thirty employed single individuals were randomly

Q29: Exhibit 13.2 A researcher with Ministry of

Q45: We use ANOVA to test for differences

Q48: Exhibit 10.9.A tutor promises to improve GMAT

Q51: For the log-log model ln(y)= β<sub>0</sub> +

Q62: The sample mean and the sample standard

Q79: Exhibit 13.9 Psychology students want to determine

Q89: Exhibit 14-3.Consider the following sample regression equation

Q92: Consider the following simple linear regression model:

Q107: Which of the following is a point