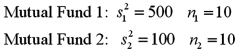

Exhibit 11-6.A financial analyst examines the performance of two mutual funds and claims that the variances of the annual returns for the bond funds differ.To support his claim,he collects data on the annual returns (in percent) for the years 2001 through 2010.The analyst assumes that the annual returns for the two emerging market bond funds are normally distributed.Here are some relevant summary statistics.  Refer to Exhibit 11-6.For the competing hypotheses:

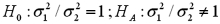

Refer to Exhibit 11-6.For the competing hypotheses:  since

since  ,approximate the p-value for the test.

,approximate the p-value for the test.

Definitions:

Alcohol

A psychoactive substance commonly found in beverages such as beer, wine, and spirits, known for its intoxicating effects.

Sleepwalking

A sleep disorder where a person walks or performs other complex behaviors while in a state of sleep.

REM Sleep

A phase of sleep characterized by rapid eye movements, during which the most vivid dreams occur, and is considered critical for memory consolidation and learning.

Psychological Effects

The impact of psychological factors on an individual's mental well-being and behavior.

Q23: The following table shows the observed frequencies

Q29: Exhibit 10.13.A consumer magazine wants to figure

Q30: Super Bowl XLVI was played between the

Q52: A sample of a given size is

Q54: A simple linear regression of the return

Q56: A nursery sells trees of different types

Q59: The accompanying table shows the regression results

Q72: Compute a 98% confidence interval for the

Q96: The population variance is one of the

Q98: A regression equation was estimated as <img