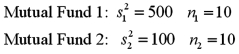

Exhibit 11-6.A financial analyst examines the performance of two mutual funds and claims that the variances of the annual returns for the bond funds differ.To support his claim,he collects data on the annual returns (in percent) for the years 2001 through 2010.The analyst assumes that the annual returns for the two emerging market bond funds are normally distributed.Here are some relevant summary statistics.  Refer to Exhibit 11-6.At α = 0.10,is the analyst's claim supported by the data using the critical value approach?

Refer to Exhibit 11-6.At α = 0.10,is the analyst's claim supported by the data using the critical value approach?

Definitions:

Neurotransmitter

Chemical substances that transmit signals across a synapse from one neuron to another in the nervous system.

Receptors

Proteins found inside or on the cell surface that respond to specific chemical signals by initiating a cellular response.

Inhibitory Synapses

These are the connections between neurons that decrease the likelihood of the recipient neuron firing an action potential.

Endorphins

Natural chemicals in the brain that act as painkillers and mood enhancers, often released during exercise, excitement, pain, and sexual activity.

Q22: Exhibit 10.14.In August of 2010,Massachusetts enacted a

Q34: Exhibit 11-3.The following are the competing hypotheses

Q36: One of the assumptions of regression analysis

Q38: A company that produces computers recently tested

Q39: The <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2339/.jpg" alt="The distribution

Q77: Exhibit 12-1 A card dealing machine deals

Q86: Exhibit 14-5.An marketing analyst wants to examine

Q87: Exhibit 9-1.A university is interested in promoting

Q90: When conducting a hypothesis test concerning the

Q99: Exhibit 9-2.The owner of a large car