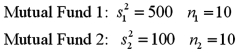

Exhibit 11-6.A financial analyst examines the performance of two mutual funds and claims that the variances of the annual returns for the bond funds differ.To support his claim,he collects data on the annual returns (in percent) for the years 2001 through 2010.The analyst assumes that the annual returns for the two emerging market bond funds are normally distributed.Here are some relevant summary statistics.  Refer to Exhibit 4-6.At α = 0.10,is the analyst's claim supported by the data?

Refer to Exhibit 4-6.At α = 0.10,is the analyst's claim supported by the data?

Definitions:

Regressive

Pertaining to a tax system in which the tax rate decreases as the taxable amount increases, commonly considered less fair because it imposes a heavier burden relative to income on those with less.

Progressive

Pertaining to a taxation system in which the tax rate increases as the taxable amount increases, imposing a higher percentage rate on the wealthy to ensure equity.

Consumption Tax

A tax on the purchase of goods or services, levied at the point of sale, designed to tax spending rather than income or savings.

Encourage Consumption

Measures or strategies aimed at increasing consumer spending and demand for goods and services.

Q6: In the estimation of a multiple regression

Q9: The mean of a continuous uniform distribution

Q10: Exhibit 10.9.A tutor promises to improve GMAT

Q13: Students who graduated from college in 2010

Q14: Consider the following data: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2339/.jpg" alt="Consider

Q25: What type of data would necessitate using

Q63: Find the value x for which:<br>A) <img

Q85: A portfolio manager is interested in reducing

Q104: Over the entire six years that students

Q107: Exhibit 15-2.A sports analyst wants to exam