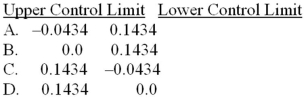

A random sample of 49 cast aluminum pots is taken from a production line once every day.The number of defective pots is counted.The proportion of defective pots has been closely examined in the past and is believed to be 0.05. Refer to Exhibit 7-11.What are the upper and lower control limits for the  chart?

chart?

Definitions:

LIFO Reserve

The difference in value between inventory calculated using the Last-In, First-Out (LIFO) method and the First-In, First-Out (FIFO) method, used to adjust COGS and inventory valuation.

Cost of Goods Sold

An accounting term for the direct costs attributable to the production of the goods sold by a company, including materials and labor.

FIFO Costs

FIFO (First In, First Out) Costs refer to an accounting method where the goods first added to inventory are the first to be sold.

LIFO Cost

An inventory valuation method ("Last In, First Out") that assumes the most recently acquired items are the first to be sold, affecting the cost of goods sold and inventory value.

Q5: According to a recent survey,women chat on

Q9: Exhibit 4-1.Two hundred people were asked if

Q20: Exhibit 5-3.Consider the following probability distribution. <img

Q34: Exhibit 8-2.The mortgage foreclosure crisis that preceded

Q49: The probability that a normal random variable

Q60: Exhibit 9-7.Vermont-based Green Mountain Coffee Roasters dominates

Q68: In a recent investigation,the National Highway Traffic

Q93: A sample space contains _.<br>A)Outcomes of the

Q96: Exhibit 10.10.A bank is trying to determine

Q99: Given normally distributed random variable X with