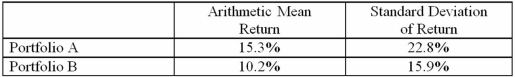

The table below gives statistics relating to a hypothetical 10-year record of two portfolios.Assume other statistics relating to these portfolios are the same and the risk-free rate is 3.5%.Using the coefficient of variation and the Sharpe ratio,the fund that is preferred in terms of relative risk and return per unit of risk is

Definitions:

Psychologist

A professional specialized in the study of mind and behavior, often involved in research, assessment, and therapy related to psychological processes and disorders.

Early-Later Experience Issue

A debate in developmental psychology regarding the degree to which early experiences versus later experiences influence the development of an individual.

Developmentalists

Experts who study the patterns of growth, change, and stability in behavior that occur throughout the entire lifespan.

Hotly Debated

A topic or issue that generates intense discussion and disagreement among people.

Q1: Media selection problems usually determine<br>A)how many times

Q14: Over the entire six years that students

Q18: By identifying and defining a problem,we have<br>A)taken

Q19: Bias can occur in sampling.Bias refers to

Q23: The purpose of media selection applications of

Q26: Based on his batting average,a baseball player

Q65: Exhibit 4-5.The following contingency table provides frequencies

Q84: The percent frequency of a category equals

Q89: Exhibit 5-13.Chauncey Billups,a current shooting guard for

Q93: Exhibit 2-3.A city in California spent six