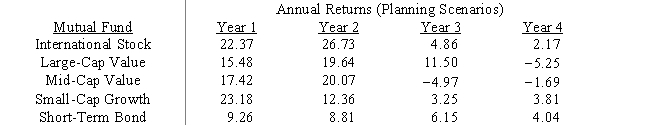

Financial planner Minnie Margin wishes to develop a mutual fund portfolio based on the Markowitz portfolio model.She needs to determine the proportion of the portfolio to invest in each of the five mutual funds listed below so that the variance of the portfolio is minimized subject to the constraint that the expected return of the portfolio be at least 5%.Formulate the appropriate nonlinear program.

Definitions:

Transformational Leaders

Leaders who inspire and motivate employees by creating a vision of future success, fostering personal development, and challenging existing limitations.

Idealized Influence

Behavior that gains the admiration, trust, and respect of followers, who in turn follow the leader’s example with their own actions.

Charismatic

Pertaining to a quality of leadership that inspires loyalty, enthusiasm, and devotion, often based on personal charm or compelling vision.

Contemporary Leadership

Refers to modern leadership approaches that emphasize adaptability, participatory governance, and the ability to navigate through changes.

Q1: In order to undertake problem solving,the first

Q14: In a multicriteria decision problem<br>A)it is impossible

Q19: The most critical component in determining the

Q19: Trend in a time series must always

Q22: Constraints in the LP models for crashing

Q28: Jackie Quinn developed the following LP formulation

Q30: A Pacific Northwest lumber company is considering

Q33: The amount by which the left side

Q40: For inventory systems with constant demand and

Q52: Which of the following is NOT true