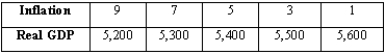

Suppose the relationship between real GDP and inflation is depicted as shown in the table below.Assume that real and potential GDP are equal to each other at $5,400 billion.Suppose government purchases decline by $100 billion and the slope of the aggregate expenditure line is 0.5.  (A)Explain how the AD curve is affected by this change.In the short run,what will real GDP and the rate of inflation be?

(A)Explain how the AD curve is affected by this change.In the short run,what will real GDP and the rate of inflation be?

(B)Using the AD and IA curves,show what will happen in the medium run.Be sure to give an economic explanation for what is happening.

(C)Using the AD and IA curves,show what will happen in the long run.

Definitions:

Sales Tax

A tax imposed by governments on the sale of goods and services, collected by the retailer at the point of purchase.

Sales Discount

From the seller’s perspective, a discount that a seller may offer the buyer for early payment.

FOB Shipping Point

A term used in shipping agreements indicating that the buyer is responsible for the cost and liability of goods during transportation once they are shipped.

Freight Charges

Freight Charges are costs incurred in transporting goods from one place to another, often included as part of the cost of goods sold or inventory for businesses.

Q19: According to Exhibit 24-6,what should have happened

Q33: A line depicting the relationship between the

Q37: The Economic Growth and Tax Reconciliation Act

Q45: The Phillips curve reflects a positive correlation

Q60: In the long run,market supply increases as

Q81: How might a change in technology in

Q87: Suppose,for a certain economy,real and potential GDP

Q105: The market demand curve in a competitive

Q141: The table below shows the percentage difference

Q147: Does the Fed have an explicit inflation