Accounting terminology

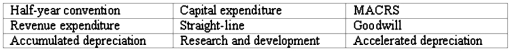

Listed below are nine technical accounting terms introduced in this chapter:  Each of the following statements may (or may not)describe one of these technical terms.In the space provided below each statement,indicate the accounting term described,or Answer "None" if the statement does not correctly describe any of the terms.

Each of the following statements may (or may not)describe one of these technical terms.In the space provided below each statement,indicate the accounting term described,or Answer "None" if the statement does not correctly describe any of the terms.

_____ (a.)An expenditure to pay an expense of the current period.

_____ (b.)The accelerated depreciation system used in federal income tax returns for depreciable assets purchased after 1986.

_____ (c.)A policy that fractional-period depreciation on assets acquired or sold during the period should be computed to the nearest month.

_____ (d.)An intangible asset representing the present value of future earnings in excess of normal return on net identifiable assets.

_____ (e.)Expenditures that could lead to the introduction of new products,but which,according to the FASB,should be viewed as an expense of the current accounting period.

_____ (f.)Depreciation methods that take less depreciation in the early years of an asset's useful life,and more depreciation in the later years.

_____ (g.)An account showing the portion of the cost of a plant asset that has been written off to date as depreciation expense.

Definitions:

Critical Incident Stress Management

A method used to help individuals and communities deal with traumatic events in a healthy manner, aiming to prevent stress-related disorders.

Intrusive

Referring to thoughts, images, or impulses that are unwelcome, often distressing, and difficult to manage or eliminate.

Evidence-Based

Referring to approaches, practices, or interventions that are grounded in and justified by well-conducted research demonstrating their effectiveness.

Resilient

The ability to recover quickly from difficulties; possessing toughness and adaptability in the face of adversity.

Q29: A stock split changes the par value

Q35: When short-term investments appear in the balance

Q42: The lower the accounts receivable turnover rate,the

Q52: If a company has 240 credit customers,there

Q57: A customer purchased merchandise for $400 which

Q83: On January 1,2015,Carleton Corporation had 55,000 shares

Q90: When the LIFO costing method is in

Q94: Accounting terminology<br>Listed below are nine technical accounting

Q119: Payroll-related expenses<br>Shown below is a summary of

Q172: Each of the following transactions would be