Depreciation and disposal--a comprehensive problem

Domino,Inc.uses straight-line depreciation with a half-year convention in its financial statements.On March 10,2010,Domino acquired a computer system at a cost of $98,800.Estimated useful life is six years,with residual value of $5,200.

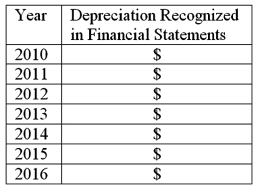

(a)Complete the following schedule,showing depreciation expense Domino expects to recognize each year in the financial statements.  (b)Assume Domino sells the computer system on October 3,2013,for $26,650.

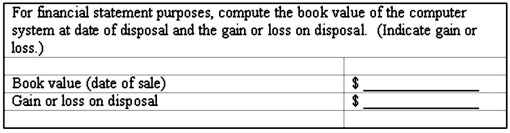

(b)Assume Domino sells the computer system on October 3,2013,for $26,650.

Definitions:

EBIT

Stands for Earnings Before Interest and Taxes, and is an indicator of a company's profitability excluding interest and tax expenses.

Depreciation

The accounting method of allocating the cost of a tangible asset over its useful life, reflecting wear and tear, deterioration, or obsolescence.

Interest Expense

The cost incurred by an entity for borrowed funds over a period of time, typically expressed as an annual rate.

Cash Coverage Ratio

A financial metric that measures a company’s ability to cover its debt obligations with its operating cash flow.

Q24: The purchase of treasury stock for cash

Q28: Inventory systems<br>Briefly distinguish between a perpetual inventory

Q50: Expenditures for research and development intended to

Q60: Amortizing a premium on bonds payable:<br>A)Increases interest

Q63: A debit balance in the income summary

Q80: The following expenditures are related to land,land

Q88: The most important factor affecting the market

Q114: Various depreciation methods-first year<br>On March 24,2015 Tastee

Q116: Notes payable<br>On September 1,2015,George Hanby borrowed $100,000

Q127: When a corporation has a right to