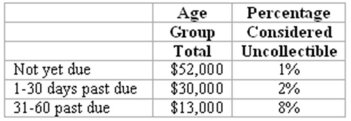

Oceanside Company uses the balance sheet approach in estimating uncollectible accounts expense.Its Allowance for Doubtful Accounts has a $1,200 credit balance prior to adjusting entries.It has just completed an aging analysis of accounts receivable at December 31,2015.This analysis disclosed the following information:  What is the appropriate balance for Oceanside's Allowance for Doubtful Accounts at December 31,2015?

What is the appropriate balance for Oceanside's Allowance for Doubtful Accounts at December 31,2015?

Definitions:

Profit Margin Ratio

A financial metric used to evaluate a company's profitability by comparing net income to revenue.

Economic Conditions

The state of a country or region's economy, influenced by factors such as GDP, unemployment rates, and inflation.

Industry Average

A statistical measure that represents the average performance or output of companies within a particular sector or industry.

Adjusting Entries

Journal entries made at the end of an accounting period to update account balances before the preparation of financial statements, ensuring records adhere to the accrual basis of accounting.

Q12: In the general ledger,a separate "account" is

Q16: The systematic write-off of intangible assets to

Q20: Accumulated depreciation is:<br>A)The depreciation expense recorded on

Q34: Retail method<br>Omega Signs uses the retail method

Q52: Depreciation expense is:<br>A)Only an estimate.<br>B)An exact calculation

Q57: The concept of adequate disclosure requires a

Q72: If sales are $270,000,expenses are $220,000 and

Q96: Book value represents the cost of an

Q96: The accrual basis of accounting recognizes expenses

Q101: During the year 2015,the inventory of Debra's