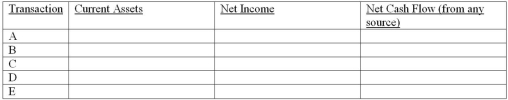

Financial assets--effects of transactions

Five events involving financial assets are described below:

(a.)Received dividends earned on investment in marketable securities.

(b.)Invested excess cash in marketable securities.

(c.)Determined that a specific account receivable is worthless and wrote it off against the allowance for doubtful accounts.

(d.)Made sale of merchandise for cash.

(e.)Sold available for sale marketable securities at a loss.Cash proceeds from the sale were equal to the current market value reflected in the last balance sheet.

Indicate the effects of each independent transaction or adjusting entry upon the financial measurements shown in the column headings below.Use the code letters,I for increase,D for decrease,and NE for no effect.

Definitions:

Ask Price

The ask price is the lowest price a seller is willing to accept for a security, commodity, or currency in financial markets.

Face Value

The nominal value printed on a bond, note, or financial document, representing its worth at maturity or when redeemed.

Term Structure

Refers to the relationship between interest rates or bond yields and different terms or maturities.

Interest Rates

The proportion of a total amount of money levied for borrowing it, usually represented as an annual rate.

Q4: Inventory systems<br>Indicate whether you would expect each

Q12: General ledgers contain information about specific control

Q15: Before making month-end adjustments,net income of Cardinal

Q21: The realization principle underlies the accounting practices

Q38: Early in the current year,Tokay Co.purchased the

Q86: Which statement is true about land?<br>A)Land should

Q89: The amount of net income (or loss)will

Q96: When a company makes a sale by

Q114: Cumberland,Inc.has applied to its bank for a

Q182: Gold Company received a two-month,12% note for