Recording transactions in T accounts; trial balance

On May 15,George Manny began a new business,called Sounds,Inc.,a recording studio to be rented out to artists on an hourly or daily basis.The following six transactions were completed by the business during May:

(A.)Issued to Manny 5,000 shares of capital stock in exchange for his investment of $200,000 cash.

(B.)Purchased land and a building for $410,000,paying $100,000 cash and signing a note payable for the balance.The land was considered to be worth $310,000 and the building $100,000.

(C.)Installed special insulation and soundproofing throughout most of the building at a cost of $120,000.Paid $32,000 cash and agreed to pay the balance in 60 days.Manny considers these items to be additional costs of the building.

(D.)Purchased office furnishings costing $18,000 and recording equipment costing $88,400 from Music Supplies.Sounds paid $28,000 cash with the balance due in 30 days.

(E.)Borrowed $180,000 from a bank by signing a note payable.

(F.)Paid the full amount of the liability to Music Supplies arising from the purchases in D above.

Instructions

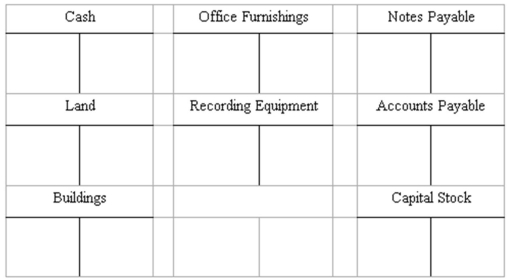

(A.)Record the above transactions directly in the T accounts below.Identify each entry in a T account with the letter shown for the transaction.This exercise does not call for the use of a journal.  (B.)Prepare a trial balance at May 31 by completing the form provided.

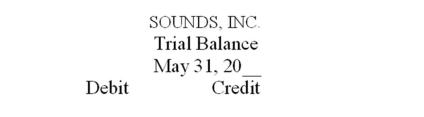

(B.)Prepare a trial balance at May 31 by completing the form provided.

Definitions:

Implicit Premises

Unstated assumptions that underlie an argument, which are not expressed but are necessary for the argument's logic to hold.

Explicit Premises

Clearly stated assumptions or propositions that form the basis of an argument or reasoning.

Yogi Berra

An American professional baseball catcher, who was known for his humorous and paradoxical quotes.

Freedom Loving

A value or trait characterized by a strong desire for autonomy and self-determination in one's actions and choices.

Q1: Which of the following statements about a

Q2: A current asset must be capable of

Q6: Trey Leeman,Operations Manager at National Consumers,Inc.(NCI),is evaluating

Q25: During the last month of its fiscal

Q37: A particular electronic component is produced at

Q48: Future value is the amount that must

Q56: Which account will not appear on an

Q70: The concept of adequate disclosure:<br>A)Demands a "good

Q93: Which of the following is not considered

Q96: If total assets equal $345,000 and total