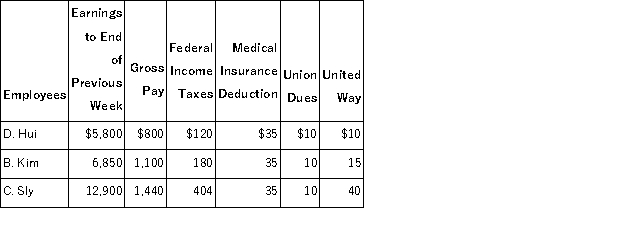

The payroll records of a company provided the following data for the current weekly pay period ended March 12.  Assume that the Social Security portion of the FICA taxes is 6.2% on the first $118,500 of earnings per calendar year and the Medicare portion is 1.45% of all wages paid to each employee for this pay period. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee. Calculate the net pay for each employee.

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $118,500 of earnings per calendar year and the Medicare portion is 1.45% of all wages paid to each employee for this pay period. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee. Calculate the net pay for each employee.

Definitions:

Personality Disorders

Extreme and inflexible personality configurations that lead to significant impairment.

Research Methods

Various strategies and techniques used to systematically investigate research questions and hypotheses.

Eccentric

Referring to behavior or habits that are unusual or unconventional.

Cluster A

Odd or eccentric personality disorders; “weird” or “mad.”

Q5: The legal contract between the issuing corporation

Q10: Duncan reported net sales of $2,523 million

Q27: Payroll is an example of a contingent

Q39: Stacey Corp. uses the direct write-off method

Q74: A company using the percentage of sales

Q77: Given the following information about a corporation's

Q117: On April 1 of the current year,

Q153: _ refers to a plant asset that

Q183: On April 1, 2015, due to obsolescence

Q202: On December 1, Victoria Company signed a