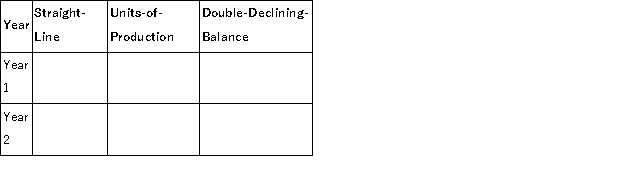

A machine costing $450,000 with a 4-year life and an estimated salvage value of $30,000 is installed by Peters Company on January 1. The company estimates the machine will produce 1,050,000 units of product during its life. It actually produces the following units for the first 2 years: Year 1, 260,000; Year 2, 275,000. Enter the depreciation amounts for years 1 and 2 in the table below for each depreciation method. Show calculation of amounts below the table.

Definitions:

CICA Handbook

The Canadian Institute of Chartered Accountants Handbook, which contains accounting and assurance standards in Canada.

Capitalize

To record a cost as a long-term asset rather than an expense, spreading the cost over its useful life.

Amortize

To amortize means to gradually pay off or write down the cost of an asset or debt over a period, often through regular payments.

Immediate Write-Off

The process of fully expensing an asset or expenditure in the current period instead of spreading its cost over its useful life.

Q14: The internal document prepared to notify the

Q76: White Company allows customers to make purchases

Q81: Uncertainties such as natural disasters are:<br>A)Not contingent

Q97: The Petty Cash account is a separate

Q112: _ leases are short-term or cancelable leases

Q142: Incidental costs added to the costs of

Q148: Effective cash management includes making efforts to

Q151: The following information is available for Montrose

Q183: Following are seven items a through g

Q194: The matching principle permits the use of