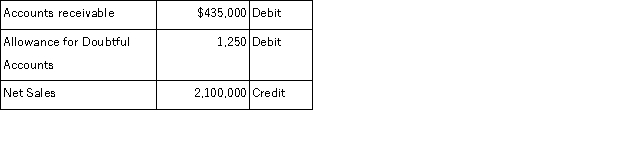

The following selected amounts are reported on the year-end unadjusted trial balance report for a company that uses the percent of sales method to determine its bad debts expense.  All sales are made on credit. Based on past experience, the company estimates 1% of credit sales to be uncollectible. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

All sales are made on credit. Based on past experience, the company estimates 1% of credit sales to be uncollectible. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

Definitions:

Unrehearsed Information

Information that has not been actively reviewed or practiced, often leading to its being forgotten or not well-integrated into memory.

Short-Term Memory

The capacity for holding a small amount of information in mind in an active, readily available state for a short period of time.

Rehearsed Information

Information that has been consciously reviewed multiple times in order to enhance memory retention and recall.

Preserving Information

The process of maintaining or keeping information intact and accessible over time.

Q11: _ are probable future payments of assets

Q37: The payroll records of a company provided

Q43: Marshall Company's bank reconciliation as of August

Q78: All of the following statements related to

Q116: Goods on consignment are goods passed by

Q129: An asset's book value is $36,000 on

Q130: The payee is the party to a

Q187: Describe the accounting for natural resources, including

Q235: Depreciation does not measure the decline in

Q240: Capital expenditures that extend an asset's useful