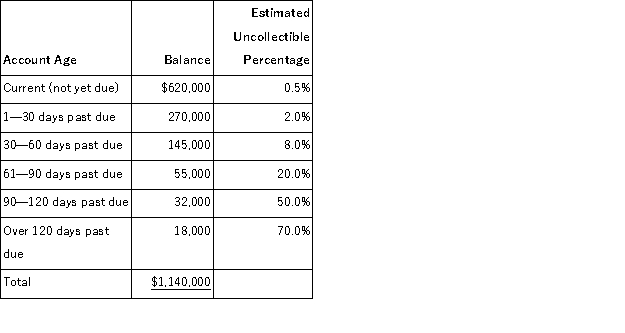

A company uses the aging of accounts receivable method to estimate its bad debts expense. On December 31 of the current year an aging analysis of accounts receivable revealed the following:  Required:

Required:

a. Calculate the amount of the Allowance for Doubtful Accounts that should be reported on the current year-end balance sheet.

b. Calculate the amount of the Bad Debts Expense that should be reported on the current year's income statement, assuming that the balance of the Allowance for Doubtful Accounts on January 1 of the current year was $41,000 and that accounts receivable written off during the current year totaled $43,200.

c. Prepare the adjusting entry to record bad debts expense on December 31 of the current year.

d. Show how Accounts Receivable will appear on the current year-end balance sheet as of December 31.

Definitions:

Summary

A concise presentation of the main points or facts, often used to provide an overview of a larger document or discussion.

Paraphrase

To restate text or speech using different words, especially to achieve greater clarity.

Direct Quotation

A report of the exact words of an author or speaker, typically enclosed in quotation marks.

Plagiarism

The act of copying someone else's work or ideas and presenting them as one's own without crediting the original source.

Q9: A company reported net sales for 2016

Q29: Hunter Sailing Company exchanged an old sailboat

Q91: A company had net sales of $230,000

Q97: The Petty Cash account is a separate

Q129: A corporation has provided the following information

Q133: The following data are taken from the

Q145: Goods in transit are included in a

Q164: If goods are shipped FOB destination, the

Q200: A company's internal control system:<br>A)Eliminates the company's

Q234: Riverboat Adventures pays $310,000 plus $15,000 in