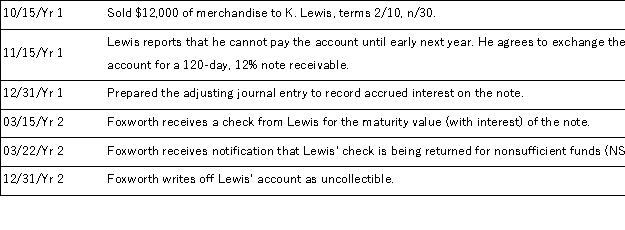

The following series of transactions occurred during Year 1 and Year 2, when Foxworth Co. sold merchandise to Kevin Lewis. Foxworth's annual accounting period ends on December 31. The company uses the net method of accounting for sales discounts.  Prepare Foxworth Co.'s journal entries to record the above transactions. The company uses the allowance method to account for its bad debt expense.

Prepare Foxworth Co.'s journal entries to record the above transactions. The company uses the allowance method to account for its bad debt expense.

Definitions:

Dividends

A portion of a company's earnings that is paid to shareholders, usually on a quarterly basis.

Fixed Assets

Long-term tangible assets that a company uses in its operations and that are not intended to be sold in the regular course of business.

Interest Expense

Interest expense is the cost incurred by an entity for borrowed funds, typically noted on the income statement as a non-operating expense.

Depreciation

A method used in accounting to divide the expenditure of a tangible asset over the time it is useful.

Q36: Vacation benefits are a type of _

Q39: Quibble Company established a $300 petty cash

Q54: Explain how to calculate times interest earned

Q65: Factoring receivables is beneficial to a seller

Q83: On a bank reconciliation, the amount of

Q108: A company had 22 units of inventory

Q132: Approved vouchers are recorded in a journal

Q133: Describe employer responsibilities for reporting payroll taxes.

Q189: A machine costing $450,000 with a 4-year

Q230: The depreciation method that produces larger depreciation