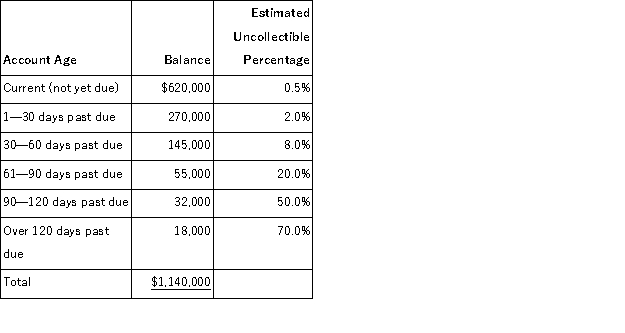

A company uses the aging of accounts receivable method to estimate its bad debts expense. On December 31 of the current year an aging analysis of accounts receivable revealed the following:  Required:

Required:

a. Calculate the amount of the Allowance for Doubtful Accounts that should be reported on the current year-end balance sheet.

b. Calculate the amount of the Bad Debts Expense that should be reported on the current year's income statement, assuming that the balance of the Allowance for Doubtful Accounts on January 1 of the current year was $41,000 and that accounts receivable written off during the current year totaled $43,200.

c. Prepare the adjusting entry to record bad debts expense on December 31 of the current year.

d. Show how Accounts Receivable will appear on the current year-end balance sheet as of December 31.

Definitions:

Q32: Given the following information, determine the cost

Q36: An asset's cost includes all normal and

Q44: Another name for a capital expenditure is:<br>A)Revenue

Q45: A company's old machine that cost $40,000

Q69: Vouchers should be used for purchases of

Q95: A company had net sales of $1,540,500

Q107: A sales system with pre-numbered, controlled sales

Q138: A check involves 3 parties: a maker

Q150: A company had inventory of 5 units

Q196: Since pledged accounts receivables only serve as