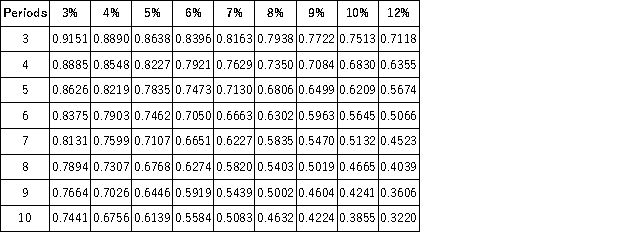

Present Value of 1  Future Value of 1

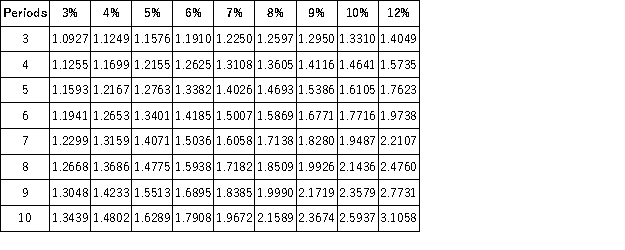

Future Value of 1  Present Value of an Annuity of 1

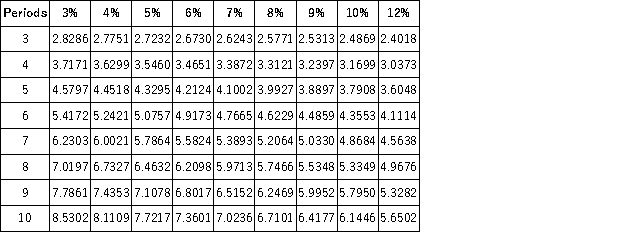

Present Value of an Annuity of 1  Future Value of an Annuity of 1

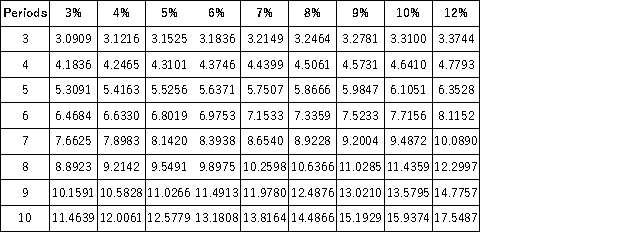

Future Value of an Annuity of 1  Kelsey has a loan that requires a $25,000 lump sum payment at the end of three years. The interest rate on the loan is 5%, compounded annually. How much did Kelsey borrow today?

Kelsey has a loan that requires a $25,000 lump sum payment at the end of three years. The interest rate on the loan is 5%, compounded annually. How much did Kelsey borrow today?

Definitions:

Future Exchange Rate

Future Exchange Rate is the anticipated value of one currency in terms of another currency at a specified date in the future, often determined through futures contracts.

British Securities

Stocks, bonds, or other financial instruments issued by companies or the government in the United Kingdom.

Total Return

The overall earnings on an investment, including both capital gains and income, over a specific time period.

Dividends

A repeat - Financial distributions made by companies to their shareholders, typically from the firm's earnings.

Q3: What media privilege,now in the shadow of

Q14: The nurse is preparing a solution that

Q20: The health care provider instructs a client

Q24: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6316/.jpg" alt="Present

Q47: Kim Manufacturing purchased on credit £20,000 worth

Q76: Partners in a partnership are taxed on

Q155: A company paid $37,800 plus a broker's

Q162: Current partners usually require any new partner

Q167: Scotsland Company had the following transactions relating

Q176: Equity securities reflect a creditor relationship such