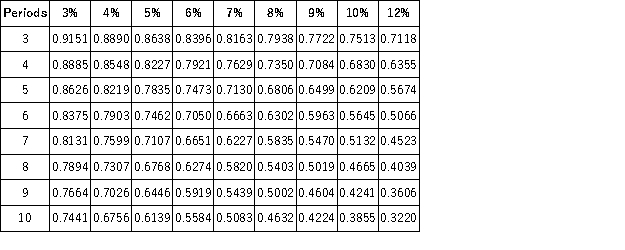

Present Value of 1  Future Value of 1

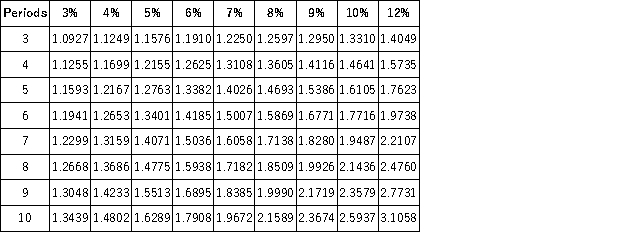

Future Value of 1  Present Value of an Annuity of 1

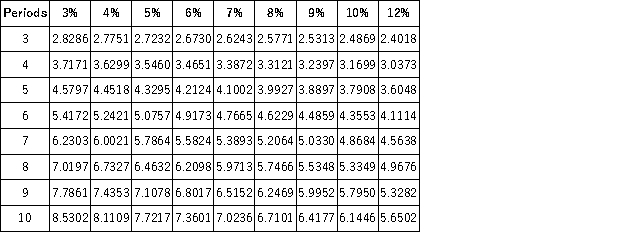

Present Value of an Annuity of 1  Future Value of an Annuity of 1

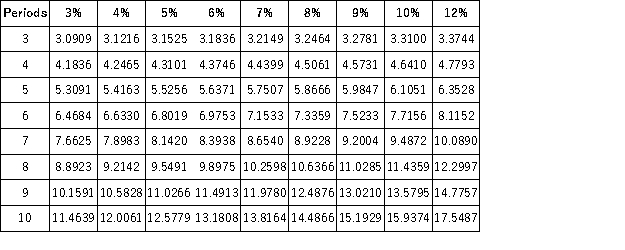

Future Value of an Annuity of 1  The present value of $2,000 to be received nine years from today at 8% interest compounded annually is $1,000.

The present value of $2,000 to be received nine years from today at 8% interest compounded annually is $1,000.

Present Value = Future Value * Interest Factor for 9 years @8%

Present Value = $2,000 * 0.5002 = $1,000

Definitions:

Cash Dividend

A payment made by a company out of its profits to shareholders, usually in the form of cash.

No-Par Stock

No-Par Stock is a class of shares which does not have a nominal or face value assigned to them, meaning the value of the shares is determined by the amount investors are willing to pay for them in the market.

Common Stock

A type of equity security that represents ownership in a corporation, with voting rights and potential for dividends.

Stock At A Premium

Stock at a premium refers to shares that are sold for a price higher than their par value, often reflecting the issuing company's perceived value and growth prospects.

Q12: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6316/.jpg" alt="Present

Q14: The following medication order has been written

Q15: In Philadelphia Newspapers v.Hepps the Supreme Court

Q15: Identify and describe the four basic financial

Q25: Wallace and Simpson formed a partnership with

Q27: Events that occur in public view almost

Q40: Zapper has beginning equity of $257,000, net

Q146: All of the following statements relating to

Q196: A company has net income of $130,500.

Q235: Use the following information as of December