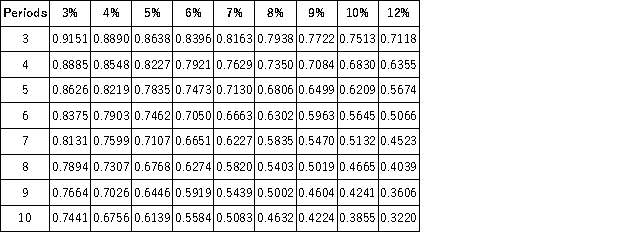

Present Value of 1  Future Value of 1

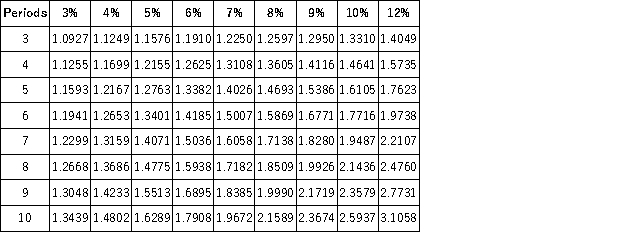

Future Value of 1  Present Value of an Annuity of 1

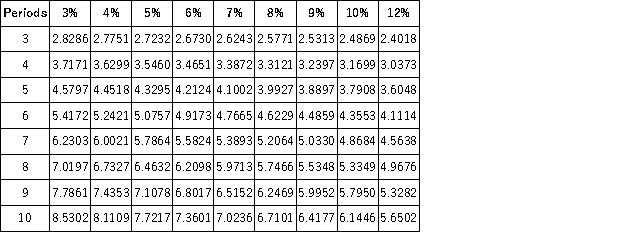

Present Value of an Annuity of 1  Future Value of an Annuity of 1

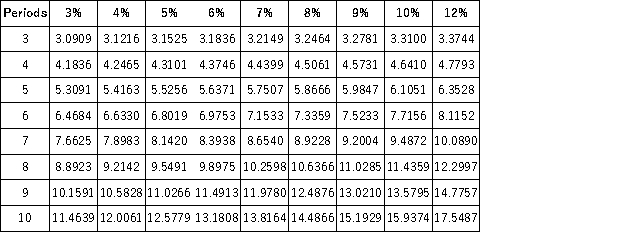

Future Value of an Annuity of 1  A company is considering an investment that will return $22,000 at the end of each semiannual period for 4 years. If the company requires an annual return of 10%, what is the maximum amount it is willing to pay for this investment?

A company is considering an investment that will return $22,000 at the end of each semiannual period for 4 years. If the company requires an annual return of 10%, what is the maximum amount it is willing to pay for this investment?

Definitions:

Sexual Orientation

A person's sexual identity in relation to the gender to which they are attracted; it is the direction of their emotional and sexual attraction.

National Origin

Refers to the country where a person was born or the country from which their ancestors came.

Dormant Commerce Clause

A legal principle that restricts states from enacting legislation that discriminates against or excessively burdens interstate commerce.

Interstate Commerce

Commercial trade, business, movement of goods or money, or transportation from one state to another, regulated by the federal government according to powers given by the Constitution.

Q1: The healthcare provider prescribes 2 milligrams of

Q1: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6316/.jpg" alt="Present

Q2: The nurse is preparing 1 part solute

Q3: The nurse reconstitutes a medication on December

Q6: A federal statute that might be used

Q7: The Smith Act rose to prominence during

Q9: Convert 0.85 to a fraction and reduce

Q16: The case of Hugo Zacchini,the "human cannonball,"

Q79: MacArthur, Strong, and Viet form a partnership.

Q147: Even if partners devote their time and