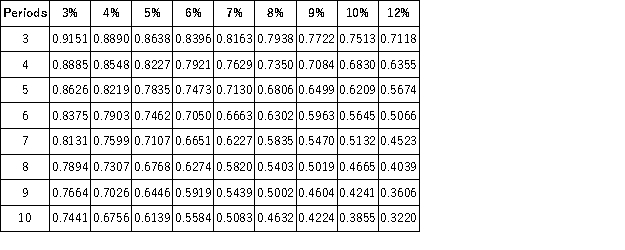

Present Value of 1  Future Value of 1

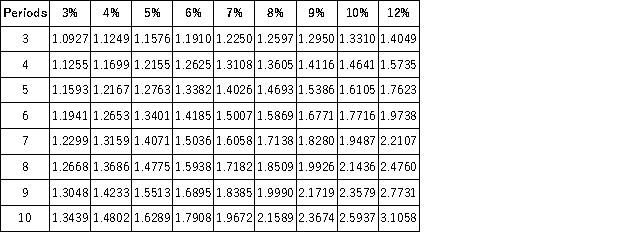

Future Value of 1  Present Value of an Annuity of 1

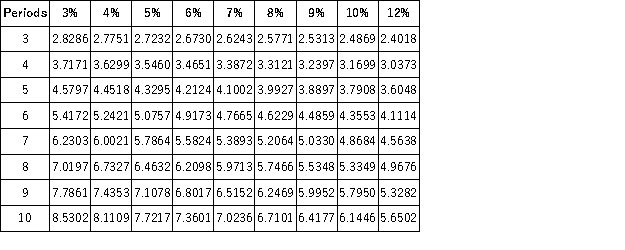

Present Value of an Annuity of 1  Future Value of an Annuity of 1

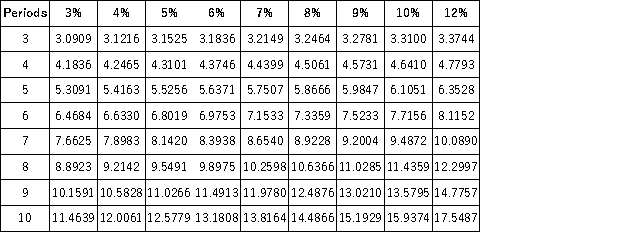

Future Value of an Annuity of 1  Sandra has a savings account that has accumulated to $50,000. She started with $28,225, and earned interest at 10% compounded annually. It took her five years to accumulate the $50,000.

Sandra has a savings account that has accumulated to $50,000. She started with $28,225, and earned interest at 10% compounded annually. It took her five years to accumulate the $50,000.

PV Factor = Present Value/Future Value

PV Factor = $28,225/$50,000 = 0.5645

0.5645 is the present value of 1 factor for 6 periods at 10%

Definitions:

Typical Level

The standard or average condition, degree, or amount for something, usually established over time through observation or measurement.

Residual Dividend Policy

A strategy where dividends are paid out of the remaining net income after meeting the company's investment needs.

Target Capital Structure

Target capital structure is the mix of debt, preferred stock, and common equity that a company aims to maintain to finance its operations and fund its growth.

Net Income

The final amount a company earns, post all deductions for expenses and taxes from its overall revenue.

Q2: The Supreme Court has made it clear

Q11: The FOIA specifies how many disclosure exemptions

Q13: The client is prescribed phenytoin suspension 250

Q14: The nurse is preparing a solution that

Q15: A client is prescribed an oral suspension.Which

Q22: In which case did the Supreme Court

Q66: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6316/.jpg" alt="Present

Q89: Return on total assets is computed by

Q93: Cinema Products LP is organized as a

Q200: On January 3, Kostansas Corporation purchased 5,000