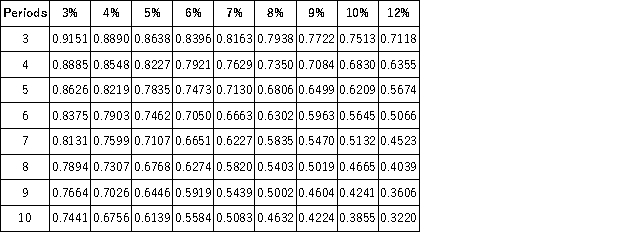

Present Value of 1  Future Value of 1

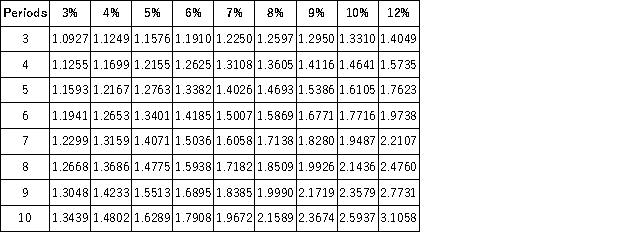

Future Value of 1  Present Value of an Annuity of 1

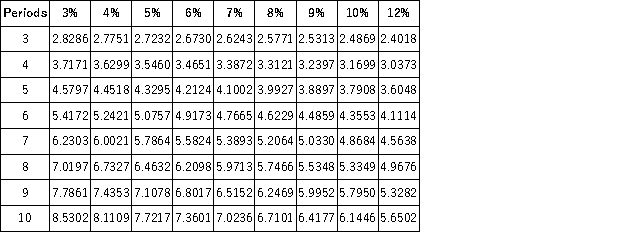

Present Value of an Annuity of 1  Future Value of an Annuity of 1

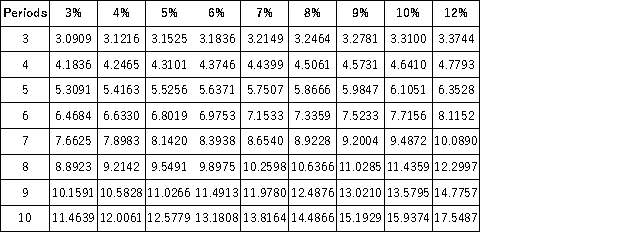

Future Value of an Annuity of 1  A company is beginning a savings plan to purchase a new building. It will be saving $43,000 per year for the next 10 years. How much will the company have accumulated after the tenth year-end deposit, assuming the fund earns 9% interest?

A company is beginning a savings plan to purchase a new building. It will be saving $43,000 per year for the next 10 years. How much will the company have accumulated after the tenth year-end deposit, assuming the fund earns 9% interest?

Definitions:

Straight-Line Depreciation

This method of depreciation spreads the cost evenly across the useful life of a fixed asset, resulting in consistent annual charges.

Variable Cost

Financial charges that are tied to the extent of production levels.

IRR

Internal Rate of Return; a financial metric used to estimate the profitability of potential investments.

Upper Bound

The highest value that a mathematical function, statistical operation, or range of variables can reach under specific conditions.

Q1: A client has a current body weight

Q11: Suppose a TV journalist officially declares his

Q16: Libel may be defined as a false

Q19: The key justification for the Supreme Court's

Q69: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6316/.jpg" alt="Present

Q107: When a partner leaves a partnership, the

Q183: Landmark Corp. buys $300,000 of Schroeter Company's

Q215: Long-term investments in available-for-sale securities are reported

Q246: The records of Roadmaster Auto Rentals, Inc.

Q270: There are three major types of business