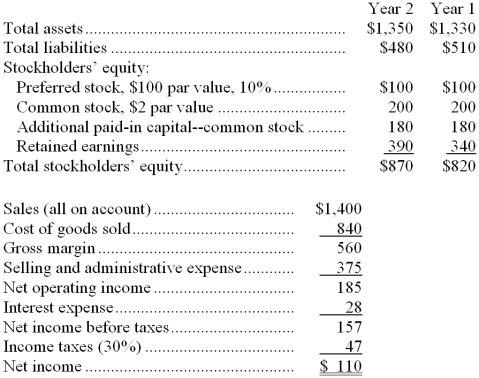

Excerpts from Stys Corporation's most recent balance sheet and income statement appear below:  Dividends on common stock during Year 2 totaled $50 thousand. Dividends on preferred stock totaled $10 thousand. The market price of common stock at the end of Year 2 was $8.20 per share.

Dividends on common stock during Year 2 totaled $50 thousand. Dividends on preferred stock totaled $10 thousand. The market price of common stock at the end of Year 2 was $8.20 per share.

-The dividend payout ratio for Year 2 is closest to:

Definitions:

Profitability Index

A financial tool that calculates the relationship between the costs and benefits of a project by dividing the present value of future cash flows by the initial investment cost.

Mutually Exclusive

Situations or events that cannot occur at the same time—choosing one precludes the selection of the other.

Negative Net Present Value

A financial metric indicating that the present value of cash inflows is less than the present value of cash outflows, suggesting the investment is not financially viable.

Initial Cost

The upfront expense incurred to purchase an asset or to initiate a project.

Q11: The accounts receivable turnover for Year 2

Q13: Statistics Canada wants to estimate the percentage

Q35: Gloster Company makes three products in a

Q38: Fouch Company makes 30,000 units per year

Q51: Shull Corporation's most recent balance sheet and

Q66: Based solely on the information above, the

Q71: Transactions that involve acquiring or disposing of

Q113: (Ignore income taxes in this problem.) Corin

Q132: Centerville Company's debt-to-equity ratio is 0.60 Total

Q185: Data from Panganiban Corporation's most recent balance