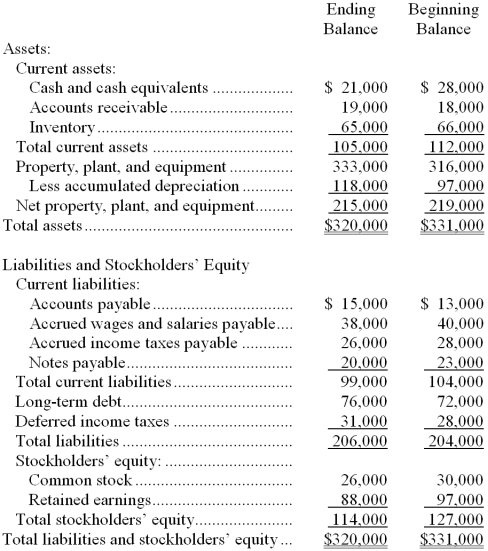

The most recent comparative balance sheet of Benefield Corporation appears below:

-Which of the following classifications of changes in balance sheet accounts as sources and uses is correct?

Definitions:

Beta

A measure of a stock's volatility in relation to the overall market; a beta above 1 indicates the stock is more volatile than the market, while a beta below 1 indicates the stock is less volatile.

Nonlinear Factor Exposures

Nonlinear Factor Exposures refer to investment sensitivities to market factors that do not change in a straight-line (linear) relationship with the market's movements.

Down-Market Betas

Measures of how securities or portfolios perform relative to a benchmark during market downturns, reflecting their sensitivity to negative market movements.

Up-Market Betas

Measures of an asset's sensitivity to market movements, particularly during periods of rising market prices.

Q2: (Ignore income taxes in this problem.) The

Q7: (Ignore income taxes in this problem.) The

Q12: If the Carrot product line would have

Q18: Nardella Company's debt-to-equity ratio at the end

Q30: For external reporting purposes, the FASB recommends

Q32: Zellner Corporation is developing direct labor standards.

Q34: The book value per share at the

Q60: Cresol Corporation has a large number of

Q99: Screening decisions follow preference decisions and seek

Q153: The current ratio at the end of