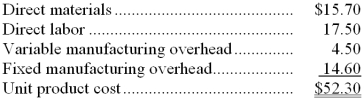

Fouch Company makes 30,000 units per year of a part it uses in the products it manufactures. The unit product cost of this part is computed as follows:

An outside supplier has offered to sell the company all of these parts it needs for $51.90 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $219,000 per year.

If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided. However, $6.20 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be applied to the company's remaining products.

Required:

a. How much of the unit product cost of $52.30 is relevant in the decision of whether to make or buy the part?

b. What is the net total dollar advantage (disadvantage) of purchasing the part rather than making it?

c. What is the maximum amount the company should be willing to pay an outside supplier per unit for the part if the supplier commits to supplying all 30,000 units required each year?

Definitions:

Amortized

The gradual reduction of a debt over a period of time through regular payments that cover both interest and principal.

Bonds Payable

Long-term debt instruments issued by corporations or governments to raise capital, with an obligation to pay interest and repay principal at a specified date.

Unamortized Premium

The portion of a bond premium that has not yet been amortized or gradually written off over the life of the bond.

Q22: Two or more different products that are

Q24: Andreoli Corporation's most recent balance sheet appears

Q24: Cintron Corporation's total current assets are $370,000,

Q34: Pugmire Corporation's net cash provided by operating

Q54: The following standards for variable overhead have

Q69: Tingstrom Inc. makes a range of products.

Q98: Ferro Wares is a division of a

Q109: When Mr. Ding L. Berry, president and

Q182: The price-earnings ratio for Year 2 is

Q268: The activity variance for administrative expenses in