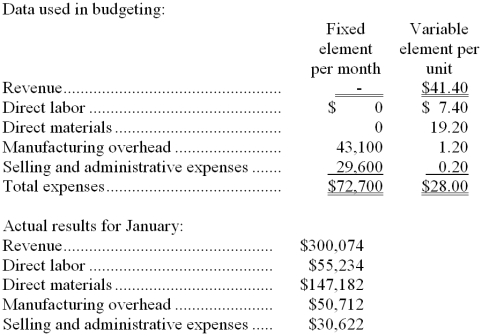

Woofter Corporation manufactures and sells a single product. The company uses units as the measure of activity in its budgets and performance reports. During January, the company budgeted for 7,600 units, but its actual level of activity was 7,560 units. The company has provided the following data concerning the formulas used in its budgeting and its actual results for January:

-The net operating income in the flexible budget for January would be closest to:

Definitions:

Working Capital

The difference between a company's current assets and current liabilities, indicating the amount of liquid assets available for day-to-day operations.

Incremental Net Income

Net income resulting from a particular action or decision, calculated as the difference in total net income if the action is taken versus if it is not.

Tax Rate

The percentage at which an individual or corporation is taxed by the government on income or profits.

After-Tax Discount Rate

The discount rate used in capital budgeting that accounts for the effects of income tax.

Q28: The overall revenue and spending variance (i.e.,

Q38: The revenue variance for January would be

Q59: Ternasky Corporation has provided the following data

Q63: Assuming that actual activity turns out to

Q72: The net income for December would be:<br>A)

Q75: The variable overhead efficiency variance for indirect

Q88: The net operating income in the flexible

Q129: During May, Phong Clinic budgeted for 2,900

Q139: Orion Corporation is preparing a cash budget

Q186: The direct labor in the planning budget