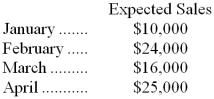

Justin's Plant Store, a retailer, started operations on January 1. On that date, the only assets were $16,000 in cash and $3,500 in merchandise inventory. For purposes of budget preparation, assume that the company's cost of goods sold is 60% of sales. Expected sales for the first four months appear below.  The company desires that the merchandise inventory on hand at the end of each month be equal to 50% of the next month's merchandise sales (stated at cost) . All purchases of merchandise inventory must be paid in the month of purchase. Sixty percent of all sales should be for cash; the balance will be on credit. Seventy-five percent of the credit sales should be collected in the month following the month of sale, with the balance collected in the following month. Variable selling and administrative expenses should be 10% of sales and fixed expenses (all depreciation) should be $3,000 per month. Cash payments for the variable selling and administrative expenses are made during the month the expenses are incurred.

The company desires that the merchandise inventory on hand at the end of each month be equal to 50% of the next month's merchandise sales (stated at cost) . All purchases of merchandise inventory must be paid in the month of purchase. Sixty percent of all sales should be for cash; the balance will be on credit. Seventy-five percent of the credit sales should be collected in the month following the month of sale, with the balance collected in the following month. Variable selling and administrative expenses should be 10% of sales and fixed expenses (all depreciation) should be $3,000 per month. Cash payments for the variable selling and administrative expenses are made during the month the expenses are incurred.

-In a cash budget for March, the total cash disbursements would be:

Definitions:

Cross-Cultural Awareness

Cross-cultural awareness involves understanding and appreciating differences and similarities across cultures, crucial for effective communication and interaction in global settings.

Dynamic Global Economy

An economic environment characterized by constant change and interaction among the world's economies, driven by technological advancements, trade, and market trends.

Joint Ventures

Business arrangements where two or more parties agree to pool their resources for the purpose of accomplishing a specific task, project, or business activity.

Cross-Border Mergers

Transactions whereby companies from different countries combine their operations or assets, often to expand market reach, diversify, or achieve competitive advantages.

Q2: Brink Tech is a for-profit vocational school.

Q19: Nimocks Inc., which produces a single product,

Q19: Duration drivers ordinarily require more effort to

Q35: Huger Corporation makes automotive engines. For the

Q53: The total number of units produced in

Q55: Furgason Corporation produces and sells a single

Q125: In a budgeted balance sheet, the Merchandise

Q126: Friden Company has budgeted sales and production

Q142: Spence Corporation, which makes skylights, has provided

Q273: The direct materials in the flexible budget