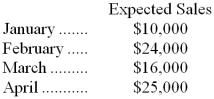

Justin's Plant Store, a retailer, started operations on January 1. On that date, the only assets were $16,000 in cash and $3,500 in merchandise inventory. For purposes of budget preparation, assume that the company's cost of goods sold is 60% of sales. Expected sales for the first four months appear below.  The company desires that the merchandise inventory on hand at the end of each month be equal to 50% of the next month's merchandise sales (stated at cost) . All purchases of merchandise inventory must be paid in the month of purchase. Sixty percent of all sales should be for cash; the balance will be on credit. Seventy-five percent of the credit sales should be collected in the month following the month of sale, with the balance collected in the following month. Variable selling and administrative expenses should be 10% of sales and fixed expenses (all depreciation) should be $3,000 per month. Cash payments for the variable selling and administrative expenses are made during the month the expenses are incurred.

The company desires that the merchandise inventory on hand at the end of each month be equal to 50% of the next month's merchandise sales (stated at cost) . All purchases of merchandise inventory must be paid in the month of purchase. Sixty percent of all sales should be for cash; the balance will be on credit. Seventy-five percent of the credit sales should be collected in the month following the month of sale, with the balance collected in the following month. Variable selling and administrative expenses should be 10% of sales and fixed expenses (all depreciation) should be $3,000 per month. Cash payments for the variable selling and administrative expenses are made during the month the expenses are incurred.

-In a budgeted balance sheet, the Merchandise Inventory on February 28:

Definitions:

Pupil

The opening in the center of the iris of the eye, which regulates the amount of light reaching the retina.

Cornea

The clear, dome-shaped front surface of the eye that acts as a window to allow light to enter the eye.

Just Noticeable Change

The minimal difference in stimulation that a person can detect 50% of the time, also known as the difference threshold.

Weber's Law

A principle stating that the perceived change in a stimulus is proportional to the original intensity of the stimulus, affecting how differences in sensory stimuli are detected.

Q12: When sales exceeds production for a period,

Q60: The net operating income in the planning

Q66: Guthridge Inc. is working on its cash

Q77: If total units sold remain unchanged, but

Q80: What is the unit product cost for

Q86: December cash disbursements for merchandise purchases would

Q91: If Holt's variable costing net operating income

Q98: The total cash collected during January by

Q126: The activity variance for net operating income

Q138: Gildon Corporation produces metal telephone poles. In