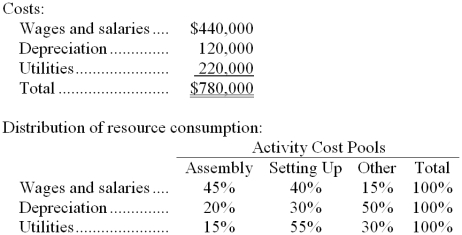

Emmette Corporation uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs and its activity based costing system:

How much cost, in total, would be allocated in the first-stage allocation to the Setting Up activity cost pool?

Definitions:

Debt-Equity Ratio

A measure of a company's financial leverage calculated by dividing its total liabilities by stockholders' equity; it indicates what proportion of equity and debt the company is using to finance its assets.

Levered Firm

A company that has debt in its capital structure, showing that it finances some of its operations through borrowing.

Static Theory of Capital Structure

A theory proposing that there is an optimal capital structure for a company, balancing the benefits and costs of debt versus equity financing to maximize value.

Financial Distress Costs

Expenses and losses incurred by a firm due to financial distress, including bankruptcy costs, agency costs, and the cost of lost opportunities.

Q5: The wages and salaries in the flexible

Q21: Budgets are used for planning rather than

Q21: What would be the average fixed cost

Q59: The company's margin of safety as a

Q65: Gallipeau Inc., which produces a single product,

Q81: The break-even in monthly unit sales is

Q92: What would be the total variable inspection

Q129: The Accounts Receivable balance that would appear

Q170: Data concerning Sa Corporation's single product appear

Q222: The cleaning equipment and supplies in the