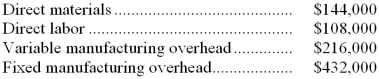

During its first year of operations, Holt Manufacturing Company incurred the following costs to produce 200,000 units of its only product:  Holt also incurred the following costs in the sale of 180,000 units of product during its first year:

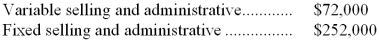

Holt also incurred the following costs in the sale of 180,000 units of product during its first year:  Assume that direct labor is a variable cost.

Assume that direct labor is a variable cost.

-What would be the cost per unit of Holt's finished goods inventory at the end of the first year of operations under the variable costing method?

Definitions:

Income Tax Payable

The amount of income tax a company or individual owes to the government but has not yet paid at a specific date, found on the balance sheet.

Pre-Tax Book Income

Earnings of a business before taxes are deducted, as reported in its financial books.

Tax Depreciation

The allocation of an asset's cost over its useful life for the purposes of tax deductions, according to IRS rules and schedules.

Book Depreciation

The method of calculating the depreciation of an asset for record-keeping and tax purposes.

Q14: Fietsam Corporation's only product sells for $120

Q33: In September, one of the processing departments

Q36: The cost per equivalent unit for materials

Q37: Dewey Company uses the weighted-average method in

Q38: The revenue variance for January would be

Q46: At an activity level of 9,600 machine-hours

Q50: The total number of units needed (i.e.,

Q54: The occupancy expenses in the flexible budget

Q83: At an activity level of 4,500 machine-hours

Q117: Job-order costing would be more likely to