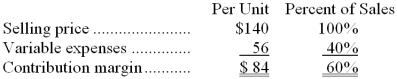

Data concerning Sotero Corporation's single product appear below:  The company is currently selling 5,000 units per month. Fixed expenses are $319,000 per month. Consider each of the following questions independently.

The company is currently selling 5,000 units per month. Fixed expenses are $319,000 per month. Consider each of the following questions independently.

-This question is to be considered independently of all other questions relating to Sotero Corporation. Refer to the original data when answering this question.

The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $9 per unit. In exchange, the sales staff would accept a decrease in their salaries of $37,000 per month. (This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 100 units. What should be the overall effect on the company's monthly net operating income of this change?

Definitions:

Poverty Threshold

The minimum level of income deemed adequate in a particular country, determining which individuals or families are classified as living in poverty.

Welfare to Work

Welfare to work programs are government or organizational initiatives designed to encourage or require individuals receiving welfare assistance to engage in employment or work-related activities.

Income Levels

Categories of annual income that differentiate individuals, households, or other groupings, often used to analyze economic and social trends.

Cost-of-Living

The amount of money needed to cover basic expenses such as housing, food, taxes, and healthcare in a certain place and time.

Q6: Whitford Corporation uses the following activity rates

Q7: What is the net operating income for

Q22: The cost(s) that Stewart Company would classify

Q49: Assuming that all of the costs listed

Q58: The cost of goods sold in a

Q67: Madtack Company's total manufacturing cost for November

Q68: Whiting Corporation has provided the following data

Q72: Tomczak Corporation has provided the following data

Q85: A disadvantage of the high-low method of

Q90: Campman Inc. uses the weighted-average method in