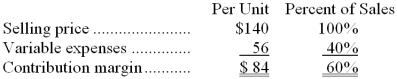

Data concerning Sotero Corporation's single product appear below:  The company is currently selling 5,000 units per month. Fixed expenses are $319,000 per month. Consider each of the following questions independently.

The company is currently selling 5,000 units per month. Fixed expenses are $319,000 per month. Consider each of the following questions independently.

-This question is to be considered independently of all other questions relating to Sotero Corporation. Refer to the original data when answering this question.

The marketing manager believes that a $12,000 increase in the monthly advertising budget would result in a 180 unit increase in monthly sales. What should be the overall effect on the company's monthly net operating income of this change?

Definitions:

Classified Balance Sheet

A financial statement that segregates assets and liabilities into short-term and long-term categories, providing a detailed view of a company's financial health.

Accounts Receivable

Money owed to a business by its customers for goods or services that have been delivered or used but not yet paid for.

Current Assets

Assets expected to be converted into cash, sold, or consumed within one year or the operating cycle, whichever is longer.

Net Income

The amount of revenue left over after deducting all expenses, taxes, and costs from total revenue.

Q12: Mateo Company's average cost per unit is

Q15: Job 607 was recently completed. The following

Q24: Beaver Company used a predetermined overhead rate

Q43: Boyar Corporation manufactures a variety of products.

Q66: The following data pertains to activity and

Q68: The following is last month's contribution format

Q70: How much supervisory wages and factory supplies

Q90: Campman Inc. uses the weighted-average method in

Q101: Advertising is a product cost as long

Q198: Data concerning Hillegass Corporation's single product appear