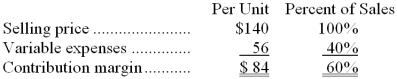

Data concerning Sotero Corporation's single product appear below:  The company is currently selling 5,000 units per month. Fixed expenses are $319,000 per month. Consider each of the following questions independently.

The company is currently selling 5,000 units per month. Fixed expenses are $319,000 per month. Consider each of the following questions independently.

-This question is to be considered independently of all other questions relating to Sotero Corporation. Refer to the original data when answering this question.

The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $9 per unit. In exchange, the sales staff would accept a decrease in their salaries of $37,000 per month. (This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 100 units. What should be the overall effect on the company's monthly net operating income of this change?

Definitions:

Schedule of Cost

A detailed report that outlines the various costs involved in producing a product, including direct materials, direct labor, and manufacturing overhead.

Goods Manufactured

The total volume of products that a company has produced within a specific period.

Managerial Accounting

It encompasses the activities of detecting, evaluating, investigating, clarifying, and distributing economic information to the leadership team for the purpose of realizing the goals of the entity.

Financial Accounting

The field of accounting that focuses on providing information to external users through financial statements.

Q6: Allegretti Corporation uses the weighted-average method in

Q55: Furgason Corporation produces and sells a single

Q57: Anola Company has two products: A and

Q73: In December, one of the processing departments

Q90: A fixed cost is constant per unit

Q95: The costs assigned to units in inventory

Q103: The Tobler Company has budgeted production for

Q115: The planning horizons for committed fixed costs

Q134: Molano Corporation has provided the following data

Q212: The selling price of Garey Corporation's only