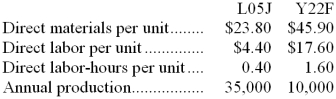

Lorello Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs). The company has two products, L05J and Y22F, about which it has provided the following data:

The company's estimated total manufacturing overhead for the year is $1,248,600 and the company's estimated total direct labor-hours for the year is 30,000.

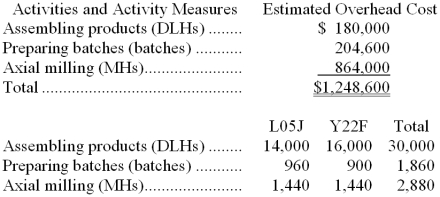

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

Required:

a. Determine the manufacturing overhead cost per unit of each of the company's two products under the traditional costing system.

b. Determine the manufacturing overhead cost per unit of each of the company's two products under activity-based costing system.

Definitions:

Dividend Payout

A portion of a company's earnings that is distributed to shareholders.

External Financing Needed

The additional funding a firm requires to finance its spending plans, such as investments in fixed assets or increases in working capital, beyond what can be funded by internal sources.

Dividend Payout Ratio

A metric indicating the proportion of a company's net profits paid out to its shareholders as dividends.

Profit Margin

A financial performance ratio that shows the percentage of profit a company produces from its total revenue.

Q1: Holding all other things constant, if the

Q1: Ingham Draperies makes custom draperies for homes

Q2: A company has a standard cost system

Q12: (Ignore income taxes in this problem.) How

Q16: Turnhilm, Inc. is considering adding a small

Q18: What was the variable overhead efficiency variance

Q50: The total Finishing Department cost after allocations

Q66: It is critical in change management to

Q99: The journal entry to record the allocation

Q104: In August direct labor was 60% of