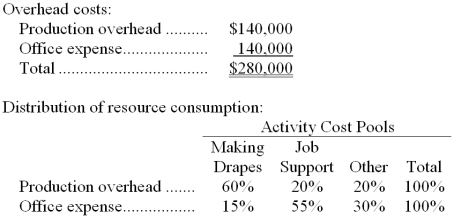

Ingham Draperies makes custom draperies for homes and businesses. The company uses an activity-based costing system for its overhead costs. The company has provided the following data concerning its annual overhead costs and its activity cost pools.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

The amount of activity for the year is as follows:

Required:

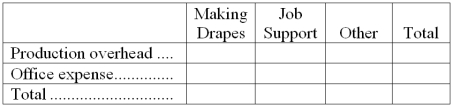

a. Prepare the first-stage allocation of overhead costs to the activity cost pools by filling in the table below:

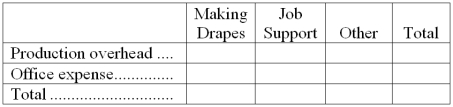

b. Compute the activity rates (i.e., cost per unit of activity) for the Making Drapes and Job Support activity cost pools by filling in the table below:

c. Prepare an action analysis report in good form of a job that involves making 67 yards of drapes and has direct materials and direct labor cost of $2,030. The sales revenue from this job is $6,600.

For purposes of this action analysis report, direct materials and direct labor should be classified as a Green cost; production overhead as a Red cost; and office expense as a Yellow cost.

Definitions:

Storage Stage

A phase in the memory process where information is retained for future use.

Consumer Recognition

The ability of consumers to correctly identify a brand or product by its attributes, such as its logo, packaging, or marketing messages.

Nostalgia

is a sentimental longing or affection for the past, typically for a period or place with happy personal associations.

Marketers

Professionals or organizations that focus on promoting and selling products or services, often through research, advertising, and sales strategies.

Q10: The debits to the Raw Materials account

Q20: Security testing involves three primary areas: _,

Q24: How much of the actual Housekeeping Department

Q29: Auchmoody Corporation has two operating divisions-a Consumer

Q32: Assuming that Cherrington Company uses the weighted-average

Q32: When the actual price paid on credit

Q57: Whole system conversion is the conversion location

Q71: Kets Corporation uses the FIFO method in

Q76: The cost of goods manufactured for April

Q77: When selecting a training method the analyst