Finkler Legal Services, LLC, uses the step-down method to allocate service department costs to operating departments. The firm has two service departments, Personnel and Information Technology (IT) , and two operating departments, Family Law and Corporate Law. Data concerning those departments follow:  Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.

Personnel costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.

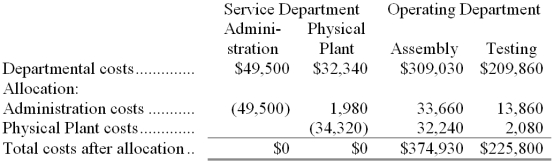

-The total Corporate Law Department cost after allocations is closest to:

Definitions:

Exemptions

Provisions that allow individuals or entities to be relieved from an obligation, such as taxes, previously imposed on them.

Corporate Income Taxes

Taxes imposed on the net income (profits) of corporations by the government.

Property Taxes

Government-imposed charges on property, calculated from the real estate's worth, intended to finance community facilities and public infrastructure.

Payroll Taxes

Payroll Taxes are taxes imposed on employers or employees, and are usually calculated as a percentage of the salaries that employers pay their staff.

Q10: Bourret Corporation is introducing a new product

Q10: What would be the total external failure

Q18: The medical services department of Bantam Company

Q18: Nolin Corporation uses the direct method to

Q19: Harvey Company recently changed the selling price

Q28: Laperriere Corporation's balance sheet and income statement

Q38: To record the incurrence of direct labor

Q54: The larger the number of programmers assigned

Q59: The cost of fixing one major bug

Q87: Which of the following is not correct?<br>A)