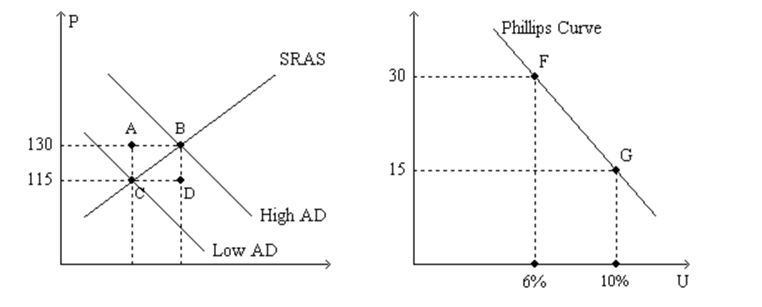

Figure 35-1.The left-hand graph shows a short-run aggregate-supply (SRAS) curve and two aggregate-demand (AD) curves.On the right-hand diagram,U represents the unemployment rate.

-Refer to Figure 35-1.What is measured along the vertical axis of the right-hand graph?

Definitions:

Marginal Tax Rate

The rate at which your last dollar of income is taxed, indicating the tax rate applied to the next dollar of taxable income.

Excise Tax

Excise tax is a specific type of tax imposed on certain goods, services, and activities, often included in the price of products like tobacco, alcohol, and gasoline.

Regressive Tax

A tax system where the tax rate decreases as the taxable amount increases, putting a higher relative burden on lower-income earners.

Direct Tax

A tax directly paid to the government by the individual or organization upon whom it is imposed, such as income tax.

Q19: If the government cuts the tax rate,

Q48: Which of the following illustrates how the

Q66: To stabilize interest rates, the Federal Reserve

Q142: One determinant of the natural rate of

Q190: If inflation expectations rise, the short-run Phillips

Q263: Studies have shown significant spending changes arise

Q330: In the long run, an increase in

Q350: The positive feedback from aggregate demand to

Q417: Refer to Figure 35-6. Curve 1 is

Q448: The theory of _ states that the