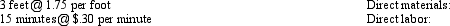

Meow Products Ltd. Meow Products Ltd. produces and sells scratching posts for cats. In the current year, the company had expected to sell 12,000 posts but actually produced and sold 10,000 posts. The following information is available regarding the standard cost to produce a single post: In the current year, 38,000 feet of material were purchased out of which 35,000 feet were used at a cost of $1.55 per foot, and 160,000 direct labor minutes were incurred at a cost of $.32 per minute.

In the current year, 38,000 feet of material were purchased out of which 35,000 feet were used at a cost of $1.55 per foot, and 160,000 direct labor minutes were incurred at a cost of $.32 per minute.

Refer to the Meow Products Ltd. information above. The company's direct materials usage variance for the current year is:

Definitions:

APT Model

Arbitrage Pricing Theory Model, an alternative to the Capital Asset Pricing Model (CAPM), asserts that the expected return of a financial asset can be modeled as a linear function of various macro-economic factors or theoretical market indexes.

Security Returns

The gains or losses from investing in a security, usually expressed as a percentage of the initial investment.

Arbitrage Opportunities

Situations where a financial instrument, or a combination of financial instruments, can be bought and sold simultaneously in different markets to profit from price discrepancies.

Q1: Armstrong Products Armstrong Products applies fixed overhead

Q7: Sarah is a 50% partner in the

Q20: Which of the following persons should not

Q35: During the post-termination transition period, property distributions

Q42: Cash received from the sale of property,

Q54: RGD Corporation was a C corporation from

Q74: The tax on cumulative taxable gifts is

Q74: JAX Inc. In early 2012, JAX Inc.

Q87: Cheshire Inc. had the following condensed income

Q99: Which of the following statements about the