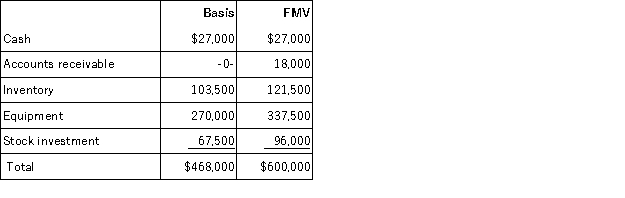

Victor is a 1/3 partner in the VRX partnership with an outside basis of $156,000 on January 1. Victor sells his partnership interest to Raj on January 1st for $200,000 cash. The VRX Partnership has the following assets and no liabilities as of January 1:

The equipment was purchased for $360,000 and the partnership has taken $90,000 of depreciation. The stock was purchased 7 years ago. What is the amount and character of Victor's gain or loss on the sale of his partnership interest?

Definitions:

Primary Nitrogenous Waste

The main form of nitrogen-containing waste products excreted by living organisms, varying among species (e.g., urea, ammonia, uric acid).

Amphibians

A class of cold-blooded vertebrates that includes frogs, toads, newts, and salamanders, characterized by their life cycle stages both in water and on land.

Accompanying Figure

An illustration, chart, graph, or image that is provided alongside a text to complement, explain, or exemplify the information being discussed.

Nitrogenous Waste

Waste products containing nitrogen, such as ammonia, urea, or uric acid, produced by the metabolism of proteins and nucleic acids.

Q8: Siblings are considered "family" under the stock

Q10: Madrid Corporation is a 100 percent owned

Q11: Deductible interest expense incurred by a U.S.

Q14: Relevant costs:<br>A) are sunk costs.<br>B) are costs

Q35: Randolph is a 30% partner in the

Q40: Paladin Corporation had current and accumulated E&P

Q43: Russell Starling, an Australian citizen and resident,

Q63: Angel and Abigail are married and live

Q100: Partners adjust their outside basis by adding

Q120: The amount of the estate tax is