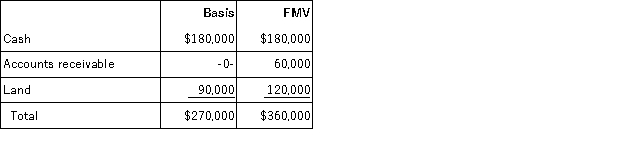

The SSC Partnership balance sheet includes the following assets on December 31 of the current year:

Susan, a 1/3 partner, has an adjusted basis of $90,000 for her partnership interest. If Susan sells her entire partnership interest to Emma for $120,000 cash, how much capital gain and ordinary income must Susan recognize from the sale?

Definitions:

Consolidated Retained Earnings

The cumulative amount of profits retained in the company and its subsidiaries after dividends are paid, as shown in the consolidated financial statements.

Net Income

The amount of money a company earns after deducting all expenses and tax obligations from its revenues.

Identifiable Net Assets (INA) Method

A valuation method in mergers and acquisitions that calculates the fair value of a company's net assets, excluding goodwill.

Goodwill

An intangible asset that arises when a business is acquired for more than the fair value of its net identifiable assets, representing items like brand name, good customer relations, and reputation.

Q11: The primary role of today's managerial accountant

Q13: Large corporations are allowed to use the

Q26: For S corporations with earnings and profits

Q53: The gross estate always includes the value

Q60: Irish Corporation reported pretax book income of

Q69: Paw-Paw Products Paw-Paw Products produces and sells

Q78: Under the entity concept, a partnership interest

Q94: The PW partnership's balance sheet includes the

Q100: S corporations generally recognize gain or loss

Q122: The estate and gift taxes share several