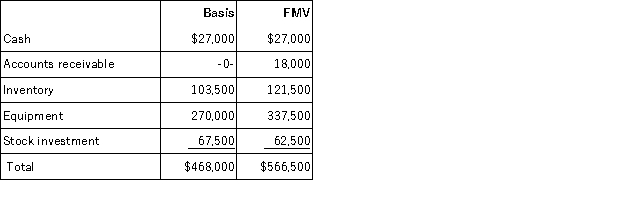

The VRX Partnership (a calendar year-end entity) has the following assets and no liabilities:

The equipment was purchased for $360,000 and VRX has taken $90,000 of depreciation. The stock was purchased 7 years ago. What are VRX's hot assets for purposes of a sale of partnership interest?

Definitions:

Net Markdowns

The reduction in the selling price of goods, subtracted from the original or previous selling price, often to clear surplus inventory.

Understated

Describes an amount reported lower than it actually is, either in financial statements or any other reporting context.

Q13: A partner can apply any passive activity

Q16: Austin Corporation, a U.S. corporation, received the

Q41: Comet Company is owned equally by Pat

Q55: Potential interest and penalties that would be

Q56: Which of the following statements best describes

Q58: Provo Corporation received a dividend of $350,000

Q73: J&J, LLC was in its third year

Q85: Distributions to owners may not cause the

Q91: A partner's self-employment earnings (loss) may be

Q92: A partner's outside basis must first be