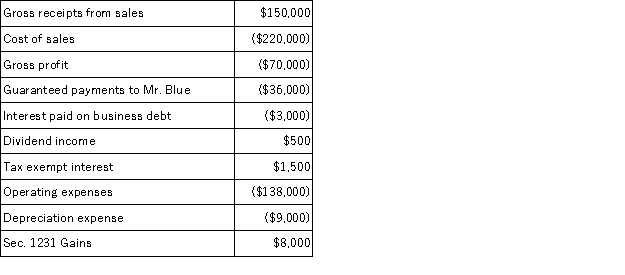

On January 1, 20X9, Mr. Blue and Mr. Grey each contributed $100,000 to form the B&G general partnership. Their partnership agreement states that they will each receive a 50% profits and loss interest. The partnership agreement also provides that Mr. Blue will receive an annual $36,000 guaranteed payment. B&G began business on January 1, 20X9. For its first taxable year, its accounting records contained the following information.

The $3,000 of interest was paid on a $60,000 loan made to B&G by Key Bank on June 30, 20X9. B&G repaid $10,000 of the loan on December 15, 20X9. Neither of the partners received a cash distribution from B&G in 20X9.

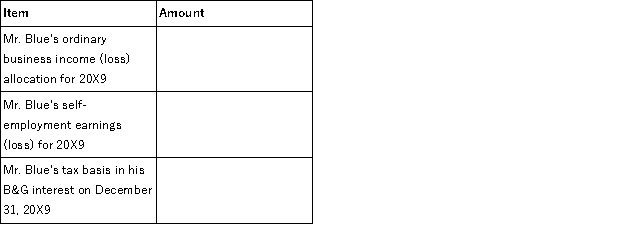

Complete the following table related to Mr. Blue's interest in B&G partnership:

Definitions:

Value Analysis

A systematic assessment to identify and eliminate unnecessary costs in product design without sacrificing functionality or quality.

Continuous Improvement

An ongoing effort to improve products, services, or processes by making incremental improvements over time.

Bottlenecks

Points of congestion or obstruction in a system that significantly delay or impede its overall function or efficiency.

Customer Value

The understanding of a product or service's value to a customer compared to other available options.

Q22: A rectangle with an inverted triangle within

Q26: Robert is seeking additional capital to expand

Q33: Gwendolyn was physically present in the United

Q64: Built-in gains recognized fifteen years after a

Q73: J&J, LLC was in its third year

Q73: Ken and Jim agree to go into

Q73: Frost Corporation reported pretax book income of

Q85: A corporation with an AMTI of $400,000

Q97: In what order should the tests to

Q100: A partner recognizes gain when he receives