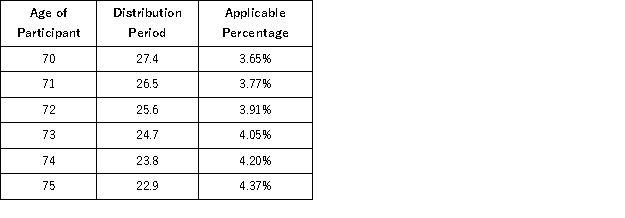

Sean (age 74 at end of 2016) retired five years ago. The balance in his 401(k) account on December 31, 2015 was $1,700,000 and the balance in his account on December 31, 2016 was $1,800,000. Using the IRS tables below, what is Sean's required minimum distribution for 2016?

Definitions:

Adopted Children

Children who have been legally taken into and raised by families other than those of their biological parents.

Genetics

A field within biology focusing on the transmission of traits from parents to offspring and the differences in these traits among individuals.

Adult Personality

The pattern of thoughts, feelings, social adjustments, and behaviors consistently exhibited over time that strongly influences one's expectations, self-perceptions, values, and attitudes.

Heritability

The proportion of observed variation in a particular trait (as within a population) that can be attributed to inherited genetic factors in contrast to environmental ones.

Q12: Weaver Company had a net deferred tax

Q12: Manassas purchased a computer several years ago

Q23: Santa Fe purchased the rights to extract

Q51: Bateman Corporation sold an office building that

Q61: Which of the allowable methods allows the

Q67: Which of the following items is not

Q76: Smith operates a roof repair business. This

Q81: Jessie sold a piece of land held

Q104: Which of the following statements is true

Q115: Corporations may carry net operating loss sustained