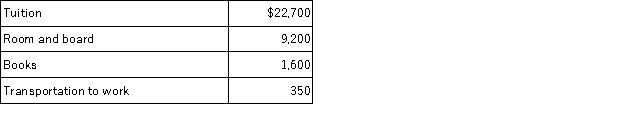

Shelby is working as a paralegal while attending law school at night. This year she has incurred the following expenses associated with school.

What amount can Shelby deduct as an employee business expense if her modified AGI this year is $25,000?

Definitions:

Fixed Cost

Expenses that do not change regardless of the production volume, including rent, salaries, and insurance premiums.

Machine Hours

A measure of the amount of time a machine is operated, used in costing and operational efficiency calculations.

Committed Fixed Costs

Long-term fixed costs that cannot be easily altered in the short run, such as leases or contracts.

Fixed Cost Per Unit

A financial metric that represents the total fixed costs divided by the number of units produced. It decreases as production increases.

Q3: This year Tiffanie files as a single

Q11: Which of the following is a true

Q14: Taxpayers who file as qualifying widows/widowers are

Q14: Troy is not a very astute investor.

Q20: If Rudy has a 25% tax rate

Q39: Employee status is always better than independent

Q49: The constructive receipt doctrine is more of

Q74: This year Darcy made the following charitable

Q76: Smith operates a roof repair business. This

Q97: Assume that Bethany acquires a competitor's assets