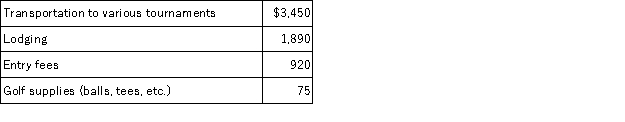

Detmer is a successful doctor who earned $204,800 in fees this year, but he also competes in weekend golf tournaments. Detmer reported the following expenses associated with competing in almost a dozen tournaments:

This year Detmer won $5,200 from competing in various golf tournaments. Assuming that Detmer itemizes his deductions and that he did not have any other miscellaneous itemized deductions, what amount of the golfing expenses are deductible after considering all limitations if the tournament golfing is treated as a hobby activity?

Definitions:

Retaliatory Tariffs

Taxes imposed by a country in response to similar taxes levied by another country, often used in trade disputes.

Imposing Tariffs

The act of applying taxes on imported goods to protect domestic industries.

Domestic Employment

Jobs located within a country's borders, contributing to its economy by providing work for its residents.

Trade Tariffs

Taxes imposed by a government on imported goods to protect domestic industries and generate revenue.

Q17: Which of the following statements regarding exemptions

Q17: Riley operates a plumbing business and this

Q26: Passive losses that exceed passive income are

Q37: Kim has decided to litigate a tax

Q44: This year, Fred and Wilma, married filing

Q51: When calculating net investment income, gross investment

Q64: Jane is unmarried and has no children,

Q68: If an unmarried taxpayer is able to

Q87: An individual may be considered as a

Q109: Scott is a self-employed plumber and his