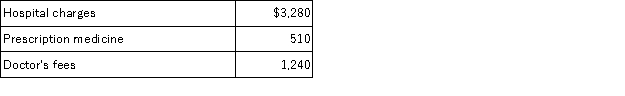

Erika (age 67) was hospitalized with injuries from an auto accident this year. She incurred the following expenses from the accident:

In addition, Erika's auto was completely destroyed in the accident. She bought the car several years ago for $18,000 and it was worth $4,700 at the time of the accident. What are Erika's itemized deductions this year if she was uninsured and her AGI is $40,000?

Definitions:

Large-Scale Medical Emergencies

Significant health crises affecting a large population or geographic area, requiring extensive medical intervention and resources.

Suspended

Temporarily halted or postponed, often referring to processes, activities, privileges, or operations until certain conditions are met or resolved.

Computer Technology Industry

A sector focused on the development, manufacturing, and sales of computer hardware, software, and services.

Organizational Structures

The systematic arrangement of roles, responsibilities, and authority within an organization, designed to facilitate coordination and efficient management.

Q35: Grace is employed as the manager of

Q61: Roy, a resident of Michigan, owns 25

Q66: Taxpayers meeting certain home ownership and use

Q69: The Internal Revenue Code of 1986 is

Q79: Jenna (age 50) files single and reports

Q80: Alton reported net income from his sole

Q89: Jorge purchased a copyright for use in

Q92: Last year Henry borrowed $15,000 to help

Q125: Baker earned $225,000 of salary as an

Q144: Kaelyn's mother, Judy, looks after Kaelyn's four-year-old