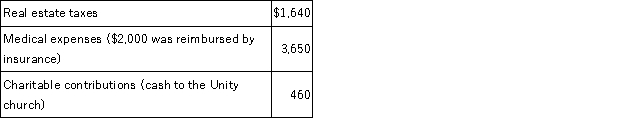

Bryan is 67 years old and lives alone. This year he has received $25,000 in taxable interest and pension payments, and he has paid the following expenses:

If Bryan files single with one personal exemption, calculate his taxable income.

Definitions:

Private Property

Land or possessions owned by individuals or entities and not by the government or public.

Public Use

The use of land or resources for the benefit and welfare of the general public.

Universal Declaration

Refers typically to the Universal Declaration of Human Rights, a historic document adopted by the United Nations General Assembly that outlines the rights and freedoms to which all human beings are entitled.

Mother Earth

A term that personifies the planet Earth, emphasizing its life-giving and nurturing aspects.

Q13: Sheryl's AGI is $250,000. Her current tax

Q37: Jones operates an upscale restaurant and he

Q47: Mason paid $4,100 of interest on a

Q51: The American opportunity credit and lifetime learning

Q57: Tax savings generated from deductions are considered

Q79: Jenna (age 50) files single and reports

Q87: An individual may be considered as a

Q94: In June of year 1, Edgar's wife

Q127: In 2016, John (52 years old) files

Q139: Persephone has a regular tax liability of